Partnership . Trust . Relationship

in

loans funded

investor return p.a*

returned

Alternative real estate investment opportunities

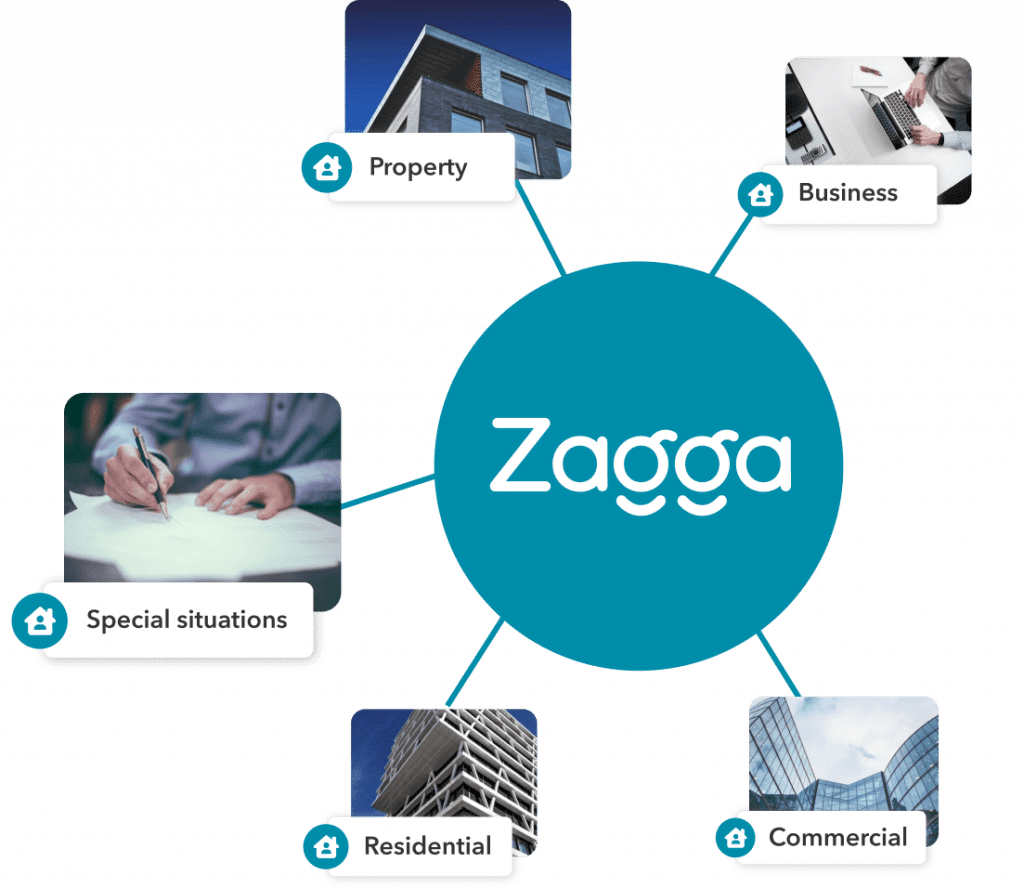

As one of Australia’s leading boutique investment manager and non-bank lender, Zagga’s objective is to generate high-yielding, alternative investment opportunities through facilitating the funding of high-quality loan transactions in the Commercial Real Estate Debt (CRED) sector

For Investors seeking alternative real estate investment opportunities

Zagga offers the alternative of accessing regular, predictable income and the option of adding a ‘middle ground’ to a well-diversified portfolio, all 100% first mortgage secured by Australian property.

For creditworthy borrowers exploring flexible, bespoke alternatives

Zagga means fast, simple and flexible borrowing for multiple loan purposes. Since 2017, Zagga has funded a range of lending transactions across a spectrum of loan purposes.

With investors facing a storm of volatile pricing, and residential property yields compressed by high purchase prices, what alternatives are there?

Our newest white paper delves into the dynamics of the fast-growing private lending market, and what’s driving it.

Explore

our lending transactions

LAND

BANKING

CONSTRUCTION

FINANCE

RESIDUAL

STOCK

INVESTMENT

PURPOSES

Typical investment opportunities

Build a diversified portfolio and add that ‘middle ground’ through investing in Commercial Real Estate Debt. Here are some recent high-yielding, alternative investment opportunities we have facilitated for our investors. Register to start exploring alternative real estate investment opportunities in Australia.

Sans Souci, NSW

10.00%

Investor return p.a. (variable)

LVR 65.42%

Residual stock

Estimated term 6-12 months

Blakehurst, NSW

9.90%

Investor return p.a. (variable)

LVR 60%

Site acquisition

Estimated term 12-15 months

Kirrawee, NSW

9.90%

Investor return p.a. (variable)

LVR 65%

Industrial warehouse development

Estimated term 15-18 months

Box Hill, NSW

10.00%

Investor return p.a. (variable)

LVR 69.34%

Land subdivision

Estimated term 12-15 months

We’re helping our borrowers bring major projects to fruition whilst also providing investors with attractive returns.

Meet the leadership team

Over 100 year’s combined experience

Alan Greenstein

CEO & Co-Founder

Alan has more than 30 years’ experience in banking and finance, following a short stint as a legal practitioner, with work experience in the UK, South Africa and Australia.

He has consulted widely to owner-managed businesses across strategy, technology and operations. He co-founded Zagga in 2016.

Frank Hageali

Director, Investments

Frank has been involved in the finance and property industry for 25 years. Prior to his last bank role as Senior Associate Director/Acting State Director NSW for ANZ Bank’s Corporate Property Group, Frankheld senior and management positions in Corporate, Institutional and Property divisions in Australia’s major financial Institutions. Most recently he was Head of Credit at Secured Lending.

Steven Levy

Director, Investments

Steve has been a part of the core team since inception and comes with a high level of experience in portfolio management, investor relations and capital markets.

As a Chartered Accountant (CA ANZ), Steve is a key operator of the business and member of both the Investment and Credit Committees

Alan has more than 30 years’ experience in banking and finance, following a short stint as a legal practitioner, with work experience in the UK, South Africa and Australia.

Frank has been involved in the finance and property industry for 25 years.

Steve has been a part of the core team since inception and comes with a high level of experience in portfolio management, investor relations and capital markets.

Alan has more than 30 years' experience in banking and finance, following a short stint as a legal practitioner, with work experience in the UK, South Africa and Australia.

Alan Greenstein

CEO & Co-Founder

Tom is an experienced company director, banker and property developer/investor.

Tom Cranfield

Director, Investment & Risk

Frank has been involved in the finance and property industry for 25 years.

Frank Hageali

Director, Property & Risk

Steve has been a part of the core team since inception and comes with a high level of experience in portfolio management, investor relations and capital markets.

Steven Levy

Director, Funding & Treasury

Simon is a qualified Chartered Accountant with 7 years’ experience in financial services prior to Zagga.

Simon Mutch

Director, Finance, Compliance & IT

Erica is a senior marketing professional with over 20 years' experience in a diverse range of financial services’ roles.

Erica Tsang

Director, Marketing & Communications

Leanne brings over two decades of expertise to her role as a seasoned leader in customer service, operations, and technology within the financial services sector.

Leanne Hui

Director, Client Services & Administration

Marcus is the Co-Founder of Zagga NZ (formerly LendMe), which he started in 2014.

Mr Cranfield is an experienced company director, banker and property developer/investor.

Erica is a senior marketing professional with over 20 years' experience in a diverse range of financial services’ roles.

Erica Tsang

Director, Marketing & Communications

Leanne brings over two decades of expertise to her role as a seasoned leader in customer service, operations, and technology within the financial services sector.

Leanne Hui

Director, Client Services & Administration

Simon is a qualified Chartered Accountant with 7 years’ experience working at PwC in financial services prior to joining Zagga.

Simon Mutch

Director, Finance, Compliance & IT

Three steps to get started

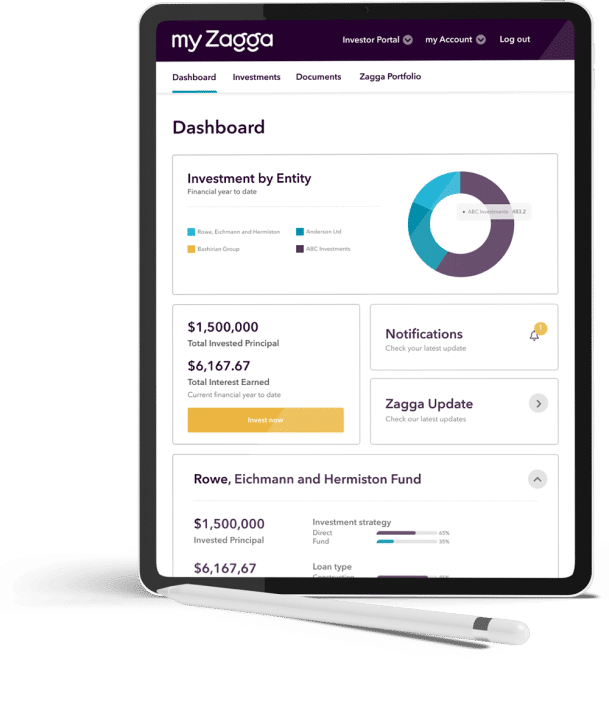

Register to start exploring the alternative investment

opportunities we offer

Register

Confirm your investment entities and status as a wholesale investor

Investment Strategy

Choose between investing directly or via one of our Funds

Invest

Earn regular income and be kept informed on your investments

Questions?

Look here.

Some types of alternative investments include real estate, private equity or venture capital, hedge funds, commodities, managed funds, art and antiquities, wine, and cryptocurrencies.

The future of alternative investments looks promising as investors continue to seek diversification, potentially higher returns, and lower correlation with traditional assets. As global economic conditions and financial markets become more volatile, alternative investments offer a hedge against inflation and economic downturns.

The rate of return on alternative investments varies depending on the type of investment and the specific investment strategy used. Some alternative investments can offer higher returns than traditional investments but also have higher risks.

Alternative investments are popular because they offer diversification benefits and potentially higher returns and provide a hedge against inflation and economic downturns.

Subscribe to our newsletter to learn more about Zagga

Client testimonials

Do you have questions about investing through Zagga?

Fill in your details to schedule a call back at a time that suits you.